Bail Education School

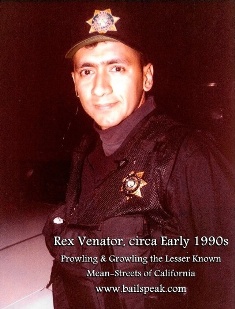

Personal Opinion Editorials re California Proposed Senate, Assembly, and Federal Bills by Bailspeak's Primary Instructor, Rex Venator

BAILSPEAK

Pre-Licensing & Continuing Bail Education

1852 West 11th Street #412

Tracy, CA 95376-3736

March 4, 2015

| Congressman Jerry McNerney 2222 Grand Canal Blvd. #7 Stockton, CA 95207 Fax: (209) 476-8587 | Majority Caucus Leader Susan Talamantes Eggman 31 East Channel Street, Suite 306 Stockton, CA 95202 Fax: (209) 465-5058 |

RE: California AB 1406 - Oppose

Greetings:

Assembly Member Richard Gordon introduced AB 1406 on February 27, 2015 to add Section 1824 to the California Insurance Code, and this bill proposes a $30.00 per bail bond transaction fee and subsequent restriction of rights of the public to access to public meetings and documents to preserve the integrity of criminal investigations.

As introduced, the language is highly problematic and, in my personal layman’s opinion, creates an astounding number of legal paradoxes with existing laws and establishes redundancy in the collections of what may now be fungible monies to the extent that existing laws and sources of investigative revenues are both redundant and unnecessary—in my personal, layman’s opinion.

Moreover, since this Bill would, in my personal opinion, allow for bail premium to be “indirectly” distributed to non bail licensees, and one can imagine how this proposed law may create the groundwork in support of changes in bail such as loosened restrictions on who can directly or indirectly receive bail premium, jail kiosks, and maybe even favoring pre-trial release in place of commercial bail.

Furthermore;

Bail premium, pursuant to Title 10 §2081. Collection and Charges Permitted.

“No bail licensee shall, in any bail transaction or in connection therewith, directly or indirectly, charge or collect money or other valuable consideration from any person except for the following purposes:

(a) To pay the premium at the rates established by the insurer and set forth on the undertaking of bail or to pay the charges for the bail bond filed in connection with such transaction at the rates filed in accordance with Section 2094.” [Emphasis Added]

§2094. Filing Schedule of Charges.

“Every bail permittee shall file with the commissioner a schedule of charges to be made for bail. He shall also file with the commissioner any change in such charges at least five days prior to the effective date thereof. Such charges and changes so filed are public records.”

I have taken the liberty of drafting a nine (9) page opinion editorial to Legislative Analyst Kendra Zoller wherein I offer that numerous other code sections present AB 1406 as paradoxical with many other existing laws, and I also personally opine how AB 1406 further presents as an anathema to long standing stare decisis and dictum to the extent that it appears on its face that persons with no background or experience in the bail or the California Bail Industry were perhaps a bit hasty in drafting the introduced bill as is and without seeking consultations with persons who have long-standing history working in bail.

I have submitted my personal opinion editorial to many persons and entities to include the California Department of Insurance, various sureties, and to Assembly Member Gordon’s offices requesting review and reconsideration.

Respectfully Submitted,

Rex Venator

1-877-726-9092

Rich Gordon’s Contact Information

Capitol Office:

State Capitol

P.O. Box 942849

Sacramento, CA 94249-0024

Tel: (916) 319-2024

Fax: (916) 319-2124

District Office:

5050 El Camino Real

Suite 117

Los Altos, CA 94022

Tel: (650) 691-2121

Fax: (650) 691-2120

SCROLL DOWN TO READ REX'S GROUNDBREAKING MEMOS

MEMORANDUM

Sent via Email

To: Kendra Zoller Date: March 2, 2015

California Department of Insurance

From: Rex Venator

Bailspeak: Pre-Licensing & Continuing Bail Education

Subject: “Fee” Imposition[1]Opinion Editorial

INTRODUCTION

The purpose of this friend of the California Department of Insurance opinion editorial is to hereafter broaden the discussion insofar that the currently available “Draft Fact Sheet” is presented as an overview but is nonetheless narrowly providing detailed information with respect to the legal authorities for taking such action and with no discernable mention of existing statutory frameworks that have been in place, the probable need to restructure existing laws, and whether or not stare decisis based governmental interference with private civil bail contracts, not between private citizens in bail transactions, but, rather, between legal corporate entities that are not natural persons and the natural person agents of such legal entities, would be found by a court of competent jurisdiction to be Constitutional or struck down as unconstitutional.

I pray the esteemed California Department of Insurance grant me latitude as a layman and lowly bounty hunter who is merely raising questions and offering thoughts and ideas in the furtherance of discovering how the California Bail Industry can remain a healthy and viable service to the California Judicial System.

1.

The Object of Bail

“The object of bail and its forfeiture is to insure the attendance of the accused and his obedience to the order and judgment of the Court…there should be no element of revenue to the state nor punishment of the surety People v Calvert (1954) 129 Cal.App.2d 693 277 p. 2d 834; People v Far West Ins. Co. (App. 1 Dist. 2001) 113 Cal.Rptr.2d 448, 93 Cal.App 4th 791, 94 Cal.App.4th 417 A; ‘Certain fixed legal principals guide us in the construction of bail statutes. The law traditionally disfavors forfeitures and this disfavor extends to forfeiture of bail...’ People v. United Bonding Ins. Co. (1971) 5 Cal.3d 895, 906).”

Moreover, the “...state has no vested interest in a forfeiture.” People v. Durbin, 64 Cal.2d 474, 477 (1966). Bail forfeiture money is a windfall to the state. Revenue to the state should not be a consideration in determination of bail controversy. See People v. Wilcox, 53 Cal.2d 651, supra at 656; People v. Calvert, 129 Cal.App.2d 693, 698 (1954); People v. North Beach Bonding Co., supra at 675; People v. Ramirez, 64 Cal.App.3d 391, 402 (1976).

The imposition of a “fee” for alleged actions by individuals—actual convictions were not listed in the Draft Fact Sheet (hereafter called, “DFS”), nor were parties named—is curious inasmuch that one has to wonder how it is that a corporation or legal entity (hereafter called “Surety” or “Sureties”) is, arguably, being subjected to punitive actions without due process[2]; moreover, by presupposing that yet another avenue of monies is necessary on top of existing statutory structures of revenues and anticipated revenue is to ignore the bail transactions where bail premium is collected, all private parties to the bail contract perform as agreed, and there is never a need to actively engage in any activity that could result in the litany of felonious behaviors described without references; indeed, by imposing a “fee,” the government is both interfering in private bail contracts between sureties and natural person bail agents and, at the same time, also penalizing sureties for every bond written irrespective of contractual outcomes to the extent that there is no statutory structure for forfeiture of any money when there is no forfeiture of bail, in my personal opinion.

Moreover, perhaps it is important to consider rather than to overlook the symbiotic relationship between sureties and the state and the fact that state action occurred when judicial officers made the judicial process available, determined that sureties’ clients are eligible for bail, what the bail amount would be, imposed bail conditions, accepted an appearance bond, and then revoked the bond when sureties’ client failed to appear as directed and thus became bail fugitives; moreover, since the state benefited from the arrangement—housing, clothing, feeding, medical upkeep, and guarding un-sentenced persons was not a necessary expense for the state—while at the same time extensively regulating bail bond companies inasmuch that state regulated sureties and their bail agents are an integral part of the trial and release process and all of which supports the fact that sureties serve an important public function. See dissenting opinion of Judge Hufstedler in Ouzts v. Maryland Nat’l Ins. Co., 505 F. 2d 547, 555-62 (9th Cir. 1974).

Nevertheless, local and state fees have been on the steady climb with respect to licensing fees, renewal fees, court fees, outrageously charged “reasonable cost” court fees, post bond forfeiture fees for exonerations, and judicial officers and even bench officers have spoken in background and even on the record that “we want the money” regarding the forfeiture of bail and the harsh penalties of summary judgment monies to be discussed in a later section of this plainly shared opinion editorial.

Succinctly put and in my personal layman’s opinion, the “Object of Bail” is purely and simply to guarantee the appearance of the accused and was never intended to be a “windfall” for the local or state governments.

2.

Bail is a Private Civil Contract and is Dissimilar to

the DFS Referenced “Life and Annuity Consumer Fund”

To compare any other type of insurance to bail is highly problematic because, by and large, relatively new lines of insurance types maintain insurance agents that are not murdered by their wanted felony fugitive clients; moreover, there is an existing statutory structure whereby millions are collected by local governments and with legal provisions for district attorney and county counsel lawyers to petition courts for reimbursement for billable hours[3].

The question here then becomes what is happening to the reported millions of dollars already being collected by local governments, and why is it necessary to install a new “fee” for the California Department of Insurance to collect “seventy percent” to the California Department of Insurance that has steadily increased licensing and renewal fees from sureties and bail agents but has historically deferred any violation of penal law to local and federal law enforcement, in my personal opinion and experience in working with the California Department of Insurance on various matters?

Let us pause and consider if the following is in any way consistent with other insurance lines.

“A bail bond is a civil contract between the government, the Surety Insurer, the Depositor of Bail and the Defendant; accordingly, ‘And the law upon these matters is well settled. Any changes in the contract, on which they are sureties, made by the principal parties to it without their assent, discharges them, and for obvious reasons. When the change is made they are not bound by the contract in its original form, for that has ceased to exist. They are not bound by the contract in its altered form, for to that they never assented. Nor does it matter how trivial the change, or even that it may be of advantage to sureties. They have the right to stand upon the very terms of their undertaking.’” Reese v. United States, (1869) 76 U.S. (9 Wall.) 13”

In 1961, the California Supreme Court held that when a defendant is released on bail bond, the defendant is, constructively, in the custody of the law as a continuance of the original imprisonment. Brewer v Muni Court(1961) 193 CA 2d 510, 14 Cal Rptr 391.

In 1969, the California Supreme Court held that furnishing bail generally allows an accused to be at liberty; however, he is technically considered as having been delivered into the custody of his sureties who are legally liable for his appearances with the terms of their undertaking. People v United Bonding Co. (1969) 274 CA 2d 898, 79 Cal Rptr 579: County of Los Angeles v Magna (1929) 97 CA 688 276 P 352.

However, when action by the authorities renders performance impossible the bail becomes void. See People v. Meyers (1932) 215 Cal.115; County of Los Angeles v. Ranger Ins. Co. (1996) 48 Cal.App 4th 992 56 Cal.Rptr.2nd 25

Also in People v. Meyers, the sole defense was impossibility of performance, and the contention is that performance was prevented by operation of law and by act of the other party to the contract. Since the other party is, in this case, the state, the two excuses become one; indeed;

“There is an implied covenant on the part of the government, when the recognizance of bail is accepted, that it will not in any way interfere with this covenant between them, or impair its obligation, or take any proceedings with the principal which will increase the risks of the sureties or affect their remedy against him.” Reese v. United States, (1869) 76 U.S. (9 Wall.) 13.

In essence, an agent of a surety who is licensed by the California Department of Insurance becomes a constructive jailer who may be tasked with very literally hunting down and apprehending wanted felony fugitives who have failed to appear in court as the result, again, of a private civil contract with the criminal courts or government.

I am not aware of any other line of insurance with this kind of English Common Law private contract analysis authority and therefore fail to find any correlation with the DFS’ implication that bail is comparable to any other line of insurance in California or, for that opinion, any other state where commercial bail is legal.

3.

The Insidious Effects of Online Continuing Bail Education &

Pre-Trial Release Programs

It would be disingenuous not to suggest that some individual persons acting as bail fugitive recovery persons and licensed bail agents are themselves becoming the focus of others in the California Bail Bond Industry who follow the rules, laws, and strive to compete in the Free Market fairly; however, one can argue that a major factor in those few who may be engaging in untoward or illegal behaviors are also the very ones who take advantage of the state’s allowance of online continuing bail education versus live classes—I am on the record as being highly critical of allowing the online education of bail agents to exist as is.

The solution several years ago via a mysterious and so-called “Ad Hoc Bail Advisory Board” was to form a sub-committee, the latter of which I did participate, to revamp bail pre licensing with no acknowledgement that nearly every person who has recently run into legal trouble most likely by-passed live continuing bail education classes; and no one really knows who exactly completed their online courses—some of which have been unchanged for approximately ten years!

I have said repeatedly that “bail is changing at the speed of a text,” and I exert enormous amounts of time and energy making sure that bail pre licensing Alumni walk out of the 22 hour course full well knowing what is legal and what is not. None of them have any excuse when they know better in their early careers.

Here we arrive at a simple question: Is it the right time to be creating massive, taxpayer funded bureaucracies that destroys public safety, jobs in the private sector, and eliminates revenues to local and state government?

What are the pros and cons when it comes to commercial bail versus pre-trial release?

| Pre-Trial “PR” Release

| Commercial “CB” Bail

|

|

|

I believe it is plainly a “perfect storm” when commercial bail is overridden by pre-trial release, buried in more and more fees and regulations, and bail agents are allowed to, some would openly say, completely avoid continuing bail education because online courses cannot confirm who it is that is actually taking such antiquated courses.

My suggestion would be to either figure out a way to make bail agents prove they are actually taking their own, regularly updated and not antiquated, online continuing bail education or to abolish online education for bail agents if for no other reason than to protect the public[4].

The DFS is searching for revenues by creating “fees” that may be found to be governmental interference with private party contracts and by force of law unconstitutional when it is the state’s own growing dependence on pre-trial release that may be causing increased jail operating costs and lost revenues via taxation of an otherwise thriving California Bail Industry up to and including summary judgment monies discussed in more detail in a later section.

4.

What about the Bail Agent Paying the “Fee?”

CALIFORNIA INSURANCE CODE

Let us presuppose that the potential governmental interference with the private civil contract between the sureties and bail agents were to be circumvented by creating a law or regulation whereby the bail agents themselves are required to somehow submit a per bond “fee.”

This is where a striking number of laws will have to be repealed, modified, and, possibly litigated, lest the bail agents would be compelled by the DFS proposal to commit numerous public offenses[5] in order to comply with the DFS “fee” proposal should it become law or a regulation.

Bail premium collected from an arrestee or indemnitor does not belong to the bail agent; it belongs to the surety; the bail agent must comply with the following insurance codes or be most likely guilty of crimes, in my personal opinion.

1733. All funds received by any person acting as an insurance agent, broker, or solicitor, life agent, life analyst, surplus line broker, special lines surplus line broker, motor club agent, bail agent, permittee, administrator as defined in Section 1759, or solicitor, as premium or return premium on or under any policy of insurance or undertaking of bail, are received and held by that person in his or her fiduciary capacity. Any such person who diverts or appropriates those fiduciary funds to his or her own use is guilty of theft and punishable for theft as provided by law. Any premium that a premium financer agrees to advance pursuant to the terms of a premium finance agreement shall constitute fiduciary funds as defined in this section only if actually received by a person licensed in one or more of the capacities herein specified.

1734. This section applies to any person licensed, whether under a permanent license, restricted license, temporary license, or certificate of convenience, to act in any of the capacities specified in Section 1733. If fiduciary funds, as defined in Section 1733, are received by such person, he shall: (a) Remit premiums, less commissions, and return premiums received or held by him to the insurer or the person entitled thereto, or (b) Maintain such fiduciary funds on California business at all times in a trustee bank account or depository in California separate from any other account or depository, in an amount at least equal to the premiums and return premiums, net of commissions, received by him and unpaid to the persons entitled thereto or, at their direction or pursuant to written contract, for the account of such persons. As used in this section, "trustee bank account or depository" includes but is not limited to a checking account, demand account, or savings account, each of which shall be designated as a trust account. However, such person may commingle with such fiduciary funds in such account or depository such additional funds as he may deem prudent for the purpose of advancing premiums, establishing reserves for the paying of return commissions or for such contingencies as may arise in his business of receiving and transmitting premium or return premium funds, or

(c) Maintain such fiduciary funds pursuant to Section 1734.5. [Emphasis Added]

Let us now revert back to charging the “fee” at the surety level and we find another conflict in Title 10[6]that would have to be resolved because the DFS proposal, should it become law or a regulation, would blatantly divert bail premium commissions to non bail licensees simply by engaging in semantics, id est: calling a commission a “fee,” in my personal opinion.

5.

Violations of Penal Law “Complaints”

Apart from Insurance Code violations listed in the “PROBLEM” section of the DFS, much of what is listed falls under penal law violations creating jurisdictional considerations in the 58 California counties and incorporated cities where there are police departments holding jurisdiction over alleged crimes and may cross state lines resulting in federal law enforcement involvement.

Again, the argument made in the DFS is that the proposed “fee” is needed ignores existing tax structures by ordinary citizens, penal law directing where summary judgment monies are supposed to go when a surety and its bail agent fail to perform on the private civil contract to guarantee the appearance of the accused, and, most counterproductive, is the growing reliance on pre-trial release where the potentiality of summary judgment monies to local governments is replaced by tax payer funded government employees and, most likely, the tax payer funded medical and retirement packages of pre-trial release government employees years later.

To propose a “fee” to fund enforcement of rogue bail agents and bounty hunters shocks the conscience if no explanation of where currently collected summary judgment monies have been distributed in keeping with the legal requirements listed above.

Stated differently, there is no need to create yet another “fee” or tax or surcharge that would also create legal paradoxes when the money to fund local governments has been in place and collecting summary judgment monies for years if not decades, in my personal, layman’s opinion.

6.

The Chilling Affect of Industry Wide Punitive Action

As a bail educator, I have personally stood before hundreds and approaching thousands of live class students now Alumni and with no known persons falling into legal trouble of which is attributable to stringent educational blocks of instruction within the meaning of the California Insurance Code, Title 10, Penal Code, Civil Code of Procedures and etceteras.

This educational standing in the California Bail Industry has put me in a position not only as a court recognized expert bail witness but also as a type of “mentor” that many, many people turn to for questions and guidance long after classes have wrapped.

I once called a California Department of Insurance employee to report possible illegal behavior, and the employee said to me, “You guys are always ratting each other out.”

By calling me a “rat,” I was not inspired to ever call again but have anyways.

The DFS proposal takes what I experienced leaps and bounds forward. Good people who take the time to report what they may think is illegal behavior are now about to be subjected to yet another “fee” or tax or surcharge or whatever the per bond amount (history tells us that $30.00 is just a starting point to be increased as weeks turn to months and later years) will become and for what—for adhering to the tenets of civic duty, protecting the public, and doing the right thing; indeed, the messages in the DFS are curious: blanket statements that, arguably, label all bail people as rampant criminals, and all are welcome to report what they believe to be wrongdoings with the caveat that all will be suffer punitive actions as a result?

7.

Suggestions for Solutions

Remedies for everything listed in the DFS “PROBLEM” section now exist in various California Codes; courts, district attorney and county counsel governmental entities are now collecting outrageous amounts[7]of fungible monies from filing fees and post forfeiture “monetary payment” that most bail agency owners are all too familiar with.

Of considerable interest in the DFS is this quote: “Current competing priorities within the CDI as well as limited resources does not allow for a comprehensive bail enforcement program.”

In my personal opinion, “...competing priorities within the CDI..,” does not justify, in any way, creating a wholly legal paradox that, on its surface, appears to tax corporations and their agents in an effort to raise redundant fungible monies to fix an internal problem that one has to wonder why can’t internal controversies be remedied with mid-level management policy changes and without having adverse affects on the California Bail Industry, the People of the State of California, and the judiciary branch of California government by creating unnecessary legal quagmires that, predictably, will fix nothing when the legal frame work to fix everything is and has been in place for years and even decades—in my personal, layman’s opinion.

In closing, it is widely reported that many, many businesses are leaving California’s harsh business climate, and, if 35,000 people do as reported[8]work in bail and pay taxes and contribute to their local economies, one has to wonder what choices will sureties have in response to the DFS proposal: contest the DFS proposal at great costs, or leave California thus eliminating the need for a California Department of Insurance bail education department, bail licensing department, and certainly any proposed bail enforcement section all together, in my personal opinion as a lowly bounty hunting layman.

Perhaps a better set of solutions is as follows:

| · Enforce existing laws · Account for summary judgment collections · Account for Court fees · Correct internal CDI priority conflicts · Overhaul or abolish online education guidelines | · Rely on existing “outreach” programs · Reconsider the wisdom of pre-trial release as a money burden · Reconsider bail as a massive source of tax revenue at no cost to taxpayers · Eliminate fungible money accounts |

Thank you so very much for the time and consideration on these aforementioned personal opinions submitted with great concern and respect, as a California Bail Educator, and I pray the California Department of Insurance strongly consider the points raised thus far prior to taking action to install what behaves like a tax but is called a “fee.”----------END OF MEMORANDUM

[1]California Department of Insurance Legislative Proposal Bail Investigation Prosecution Fund

[2]“The due process clause provides that no States shall deprive any ‘person’ of ‘life, liberty or property’ without due process of law. A historical controversy has been waged concerning whether the framers of the Fourteenth Amendment intended the word ‘person’ to mean only natural persons, or whether the word was substituted for the word ‘citizen’ with a view to protecting corporations from oppressive state legislation. As early as the 1877 Granger Cases the Supreme Court upheld various regulatory state laws without raising any question as to whether a corporation could advance due process claims. Further, there is no doubt that a corporation may not be deprived of its property without due process of law.

While various decisions have held that the ‘liberty’ guaranteed by the Fourteenth Amendment is the liberty of natural, not artificial, persons, nevertheless, in 1936, a newspaper corporation successfully objected that a state law deprived it of liberty of the press. [Emphasis Added]

See Graham: The 'Conspiracy Theory' of the Fourteenth Amendment, 47 YALE L. J. 371 (1938).

In Munn v. Illinois, 94 U.S. 113 (1877) arising under the Fifth Amendment, the Court explicitly declared the United States ‘equally with the States . . . are prohibited from depriving persons or corporations of property without due process of law.’ Sinking Fund Cases, 99 U.S. 700, 718-19 (1879).” [Emphasis Added]

[3]Penal Code §1305.3 “The district attorney, county counsel, or applicable prosecuting agency, as the case may be, shall recover, out of the forfeited bail money, the costs incurred in successfully opposing a motion to vacate the forfeiture and in collecting on the summary judgment prior to the division of the forfeited bail money between the cities and counties in accordance with Section 1463.”

[4]Insurance Code §1737 “The purpose of this chapter is to protect the public by requiring and maintaining professional standards of conduct on the part of all persons licensed hereunder.”

[5] 1814. “The violation of any foregoing provision of this chapter, or of any rule of the commissioner made pursuant thereto, is a public offense, punishable by fine not exceeding ten thousand dollars ($10,000), or by imprisonment in the state prison, or in the county jail not exceeding one year, or by both such fine and imprisonment.”

[6]Title 10 §2054.4 “Payment of Commissions; Unlawful Rebates; Prohibited. No person may receive commission on bail or the transaction of bail as defined in Section 2054.3 unless he holds a bail license as defined in Section 2054.1. No bail licensee shall pay or allow in any manner, directly or indirectly, to any person who is not also a bail licensee any commission or other valuable consideration on or in connection with a bail transaction. This section shall not prohibit payments by a bail licensee to an unlicensed person of charges such person for services of the kind specified in Section 2081(c) and (d).”

[7] PC §1306(b) “A monetary payment as a condition of relief to compensate the people for the costs of returning a defendant to custody pursuant to Section 1305, except for cases where the court determines that in the best interest of justice no costs should be imposed. The amount imposed shall reflect the actual costs of returning the defendant to custody. Failure to act within the required time to make the payment imposed pursuant to this subdivision shall not be the basis for a summary judgment against any or all of the underlying amount of the bail. A summary judgment entered for failure to make the payment imposed under this subdivision is subject to the provisions of Section 1308, and shall apply only to the amount of the costs owing at the time the summary judgment is entered, plus administrative costs and interest.

[8]According to Topo Padilla.

Assembly Bill 1406 – HELD UNDER SUBMISSION – "An action taken by a committee when a bill is heard in committee and there is an indication that the author and the committee members want to work on or discuss the bill further, but there is no motion for the bill to progress out of committee. This does not preclude the bill from being set for another hearing."

LAST HIST. ACT. DATE: 05/28/2015

LAST HIST. ACTION : In committee: Held under submission.

COMM. LOCATION : ASM APPROPRIATIONS

TITLE : An act to add Section 1824 to the Insurance Code, relating to insurance.

SCROLL DOWN To Read Below AB 1406 Opposition Opinion Editorials by Rex Venator

[Note: Originally Proposed “Fee” was $30.00 Per Bond]

Hover over above image to read the associated Opinion Editorial on how to gain Large Signature Bond Approval

Hover over the above image to view a 2003 Prediction re "The Return of the Bounty Hunter" that has come to pass.

Copyright 1992 to 2015, Bailspeak, All Rights Reserved

“Keep up the great job. Rex is outstanding & friendly, also we can relate to him & call him if we need someting. [I liked] everything! Great job, thanks for coming.”

“Rex really knows his material & is current with the bail laws.”

“Another well done presentation from Rex! Ease of understanding course materials because of Rex. Rex is very knowledgeable and easy to learn from.”

“How material is presented (with many examples). Very easy to follow and stay involved with real case and scenarios.”

“Gaining more knowledge about the subjects discussed.”

“Bailspeak teaches real-world bail; these classes are what’s really going on.”

~ Multi-Million Dollar a Year Bail Bond Producer and new Bail CE Alumnus, 2015

“Anecdotal review.”

“I liked the way Rex explained everything.”

“I liked the “slides” that were drawn out or written out on the board. I liked having breaks often to use the restroom.”

“Lots of great info regarding under discussed subjects in the industry. Very informative and beneficial. Thank you, it really explained a lot.”

“Very educational! In discussions we would really get the info sank in with stories and scenarios.”

“The specifics, energy, the way in which the instructor taught the class. Rex was very knowledgeable and I appreciated the specific way he teaches his class; it helped me to retain the information more than most classes in this same short amount of time.”

“It was made interesting which made the time go by quickly.”

“Wish we could have teachers [in colleges and schools] teach this way. Would be a much better pass rate! That it was very active. Real live examples. Now I know a lot about bail. So helpful. Keep me in mind because I’m like a “shark”! LOL

“Overall, I have learned so much information regarding bail, and the bail process. I now understand more of the penal codes & insurance codes for which I hadn’t before. Learning this information has made me more capable of fully understanding bail. It has made me an asset now because of the amount of information I have collectively learned. Keep up the good work Rex. You have taught me so much already!”

“Would love the class to be longer, add an extra day! Information was broken down to where I can understand it. Thank you for all the encouragement, I’ll keep trying!”

“Great class and grateful to be a part of it. Gathered plenty of useful information to enhance my knowledge of proper work ethic/standards. Wish the class was longer! Time was well spent.”

“The information was exactly what I was looking for and very helpful! Rex was great very helpful well worth the money and time.”

“The information provided to me was a lot but the instructor provided the information in the way that made it easy to grasp. The information packets that can be used as a study guide to the exam as well as in my future career as a bail agent. I can honestly say, without a doubt or hesitation, there was nothing I didn’t like about this course. Thank you for all your information! It is comforting to be instructed by someone with as much experience as yourself!”

“The way Rex broke everything down to understand the class.”

“Instructor is very knowledgeable. Very interactive. Great course!”

“I learned a lot about law, very informative. I think it was great and so was the instructor!”

“ Depth of information not typical of most courses. Good, lively atmosphere, engaged learning.”

“Everything was very helpful and Rex kept it interesting.”

“Good instructor. Instructor experience.”

“Very professional and knowledgeable. I loved how it was related to actual events that pertained to real life. I don’t have any dislikes! Very professional.”

“Lectures and handouts!”

“How Rex brought in real life situations to the codes. Thank you for bringing light on all codes. I was lost, Rex found me.”

“Kept me awake.”

“So much good info! See you next time!”

“Learned a lot.”

“The use of examples on everything.”

“The law aspect; I enjoyed learning about courtroom procedures. I will definitely take more courses with Rex!”

“Great instructor! Instructor kept us all “alive” no matter how tired we were. This class was a great way to learn about bail.”

“Everything! Rex made it all make sense. I like everything from A to Z.”

“Very clear, easy to understand; handouts.”

“I liked everything! Thank you!”

“I liked everything! Thanks a lot!”

“Ability to learn by the associations made by the instructor. Instructor is personable and patient – encouraging student participation seemed effortless.”

“Rex made it flawlessly understandable. Rex is very professional and resourceful in all material.”

“Rex is very knowledgeable and helped me learn a lot. Always answered questions made me want to take the bail agent test.”

“[I liked] How organized the instructor was and how helpful the material handouts are.”

“Excellent instructor! Made information relevant.”

“[I liked learning] knowledge that will keep me safe and out of jail.”

“The in depth explanation of bail and consequences.”

“Everything about the bail bonds and bounty hunting was great!”

“The instructor was very specific and used life events as examples.”

“Rex, you’re awesome! Explain information very well, easy to follow. [I liked] Everything! Crash course, but glad its pretty easy to understand! Thank you! I can’t wait to tell you I passed the exam!”

“The real life examples & practical application.”

“The anecdotes & reviews. Rex, continue teaching!”

“I liked topic on bounty hunting. Good job!”

“I totally loved all the instructor’s personal stories & experience. Very awesome & knowledgeable.”

“Rex has taken a lot of time and effort into this and it greatly shows. Rex kept us on our toes! Keep up the great work!”

“The handouts. Rex uses the codes to real life references.”

“Great example how the codes apply to actual court cases. Very informative.”

“I enjoyed the class. The instructor was very professional and explained everything really good. I will highly recommend to anyone. What I liked about this course is that the instructor explained everything with detail.”

“It

is the constant exposure to Insurance Codes and Title 10 and in combination

with my nearly quarter century of working in all aspects of the California Bail

Bond Industry that I am able to look at the equations presented by a proposed

senate or assembly bill and almost instantaneously decide if there are any

legal paradoxes or Constitutional considerations that should be shared with our

lawmakers.”

~ Rex Venator, Live Class Bail Pre-Licensing Educator of nearly a Decade

Bakersfield 20 Hour Bail Agent Pre-Licensing Class

Bail Agent Pre Licensing Alumni Quotes from Post Bailspeak Course Evaluation Surveys.

Modesto - Salida Bail Bonds and Bounty Hunter Pre Licensing

San Jose Bail Agent and Bail Fugitive Recovery Certification Class

Sacramento Roseville Bail Agent Pre Licensing Course

Sacramento Bail Enforcement and Bail Agent 20 Hour Bail Pre-Licensing Class

San Diego County Bail Pre Licensing Certification Courses

Introduced on February 21, 2013

By Assembly Member Hueso

OPINION EDITORIAL & ANALYSIS

By Rex Venator

To all who shall see these Presents Greetings:

It has been nearly a year since Senate Bill 1265, carried by Senator Vargas, inspired nearly the exact same opinion editorial and analysis language as Assembly Bill 773, but how is it that a year old and defeated senate bill could fall under the same language as an assembly bill as of the time of this writing?

Please be patient and allow me a bit of latitude while I expound on my personal opinions and offer analysis that is backed by code sections that are required to be taught in California bail agent pre-licensing classes.

First, we are compelled here to ask a simple question drawn from natural human curiosity: how is it that Assembly Bill 773 could have the same analysis as Senate Bill 1265 did nearly a year ago? Could it be that the same attempt—if one thinks long term and big picture to follow the consequences to a logical conclusion—to render the California Department of Insurance and its commissioner, with all due respect but also to draw focus to the point, irrelevant insofar as “protecting the public” from known “criminals”and “persons of bad business reputations?”

In my personal opinion, Assembly Member Hueso’s Assembly Bill 773 (hereafter called, “Bill”) is, predictably, highly problematic and on many fronts to include requiring legislative change in other areas, lest a judicial body may have ample causation to strike down the Bill if it is eventually signed by the Governor as is.

1.

Bill Language

Of notable interest are a couple of areas in the Bill as follows:

Section 1. 1810 subsections

(b) A license may be held by a corporation or a limited liability company (LLC), in which case all of the following requirements shall be met...

(3) One hundred percent of the shares of the corporation or membership interest in the LLC shall be held by licensed bail agents, unless the corporation or LLC is an admitted surety insurer or is a subsidiary of an admitted surety insurer. [Emphasis Added]

Current law regarding “natural persons” and “corporations” holding bail agent licenses is logically and profoundly layered inasmuch that with the study of each section the prior sections are reinforced by subsequent sections.

The addition of passing an ambiguous Bill to allow a Limited Liability Corporation (hereafter called “LLC”) would necessarily require a massive restructuring of the aforementioned reinforced layers of logical laws further described below, in my personal opinion.

2.

“...unless...is a Subsidiary...”

In my person opinion, the word subsidiaryshould be very clearly and plainly defined and described and cross referenced with existing law to avoid legal paradoxes. For examples:

Corporate Code §13400 or the "Moscone-Knox Professional Corporation Act" plainly spells out who can be a part of a “Professional Corporation” LLC pursuant to Corporate Code §13406 to the extent that a bail agent or bail insurance agent is NOT listed anywhere in Corporate Section §13401.5, but it does allow for “future” changes to the Business & Professions Code with no mention of Insurance Code insofar as my layman’s research indicates.

It appears from the Bill that a person working or holding a controlling interest in a “subsidiary” will notbe required to hold a bail agent license pursuant to California Insurance Code §1800 subsection (a), which then excludes such a person—perhaps one of the “prohibited associations” defined in Title 10 Code §2057 that includes lawyers and law enforcement employees—from having fiduciary responsibilities to “protect the public” as defined in California Insurance Code §1737 by acting in a “Fiduciary Capacity” pursuant to California Insurance Code §1733.

One may even be able to argue that if a bail agent in an organization that does something that can lead to suspension or revocation by all the organization’s bail agents, those non-bail agents may be immune from the commissioner under California Insurance Code §1739 plainly and simply because the Bill would exclude such persons from becoming licensed bail agents.

Ignorance would be applicable to such persons described in the above paragraph if they were never required to be tested to “protect the public” or even be required by existing law to “maintain professional standards” as current law does make any person who transacts bail accountable as described throughout the California Insurance Code and Title 10.

A person could, arguably, be shielded if that person, under the proposed Bill, from any consequences now described by failing to keep books pursuant to California Insurance Code §1745 – 1746.

As a bail education instructor, I have taught over 1,000 people in live seminars on Insurance Code sections and Title 10 sections to the extent that my background should carry weight in combination with my total time of 21-years as a bounty hunter and licensed bail agent.

3.

The Transacting of Bail

Since the ambiguity of what an admitted surety insurer’s “subsidiary” is, we are, by a logical force of action, compelled to explore hypothetical abuse by persons not subject to the insurance commissioner’s authorities to include enforcement if such scenarios are envisioned to, once again, logical conclusions.

A person not licensed will not have been required to take not less than 20-hours of bail pre-licensing and be certified to understand that premium may not be indirectly distributed, irrespective of the Prop 103 law firm opinion espousing “rebating”(a euphemism for discounting bail in my personal opinion) bail, to non-licensed bail agents pursuant to Title 10 Code 2054.4, or that those in a “subsidiary” may work with persons of “bad business reputations” or “criminals” now prohibited by Title 10 Code 2057 subsection (e), or that a subsidiary employee may be allowed under the proposed Bill to refer attorneys now contrary to Title 10 Code 2071, nor would there be anything to prohibit employees of a “subsidiary” from advertising in a court or jail or be restricted by current law as sole proprietor bail agents and bail agent officers and shareholders of corporations now are.

In short, the possibilities for future abuses is SPECTACULAR and the Bill’s possible impact does not end with the above described hypothetical, well, predictions, if one would be so gracious as to allow.

4.

Who Would Be Able to Transact Bail?

In my personal opinion, I fail to see where the Bill, as written, would end at a bail related “subsidiary.”

What if an admitted surety insurer contracted with, let us say a sheriff’s department, to establish a private “subsidiary” in California’s county jails? Such a “subsidiary” would, under the current language of the Bill be excluded from being staffed by licensed bail agents who otherwise could not be employees of a law enforcement agency who would then not be required to be licensed as bail agents.

Then we have no logical other direction but to now arrive at “subsidiary”employees who, arguably, could receive monies from bail premium while at the same time—under the current language of the Bill—not be required to hold a professional license as required by the Corporate Code and, arguably, actually be felons and transact bail with no obvious ramifications common to licensed bail agents in California today.

Moreover, why even keep enforcement language in the Insurance Code and Title 10 if a licensed bail agent could commit multiple felonies, violate the public trust, be stripped of his or her bail agent license by the commissioner and then merely reenter bail as a shadowy “subsidiary?

5.

Case in Point

Section 2 in the Bill goes to supporting my personal opinion and here is why:

“No reimbursement is required by this act pursuant to Section 6 of Article XIII B of the California Constitution because the only costs that may be incurred by a local agency or school district will be incurred because this act creates a new crime or infraction, eliminates a crime or infraction, or changes the penalty for a crime or infraction, within the meaning of Section 17556 of the Government Code, or changes the definition of a crime within the meaning of Section 6 of Article XIII B of the California Constitution.”

The audacious avarice and hubris of how this section is so outrageously smoke and mirrors truthful but wrapped as a warm fuzzy gift to the taxpayer shocks the conscience of the reasonable person because, in my personal and layman’s opinion, it is true inasmuch that the Bill strips away the rule of law from those who would form a “subsidiary” so there is no reimbursement necessary because, logically, crimes and punishments are removed for those in the “subsidiary!”

The paradox to follow is while Section 2 of the Bill creatively harbors truth, it is, at the same time, overlooking the massive expense of restructuring sections of the Government Code, Insurance Code, Corporations Code, and who knows what the cost for taxpayers will be when all of which is taken to the California Superior Courts to be sorted out.

6.

Closing Opinions & Conclusions

In my personal opinion, it is plainly stated that there are no penalties added or removed or anything else, and it is my view that this is because persons working for a “subsidiary” are not held to the same legal standards of licensed bail agents.

This Bill, in my personal opinion, would allow for out-of-state “subsidiaries”staffed by persons unknown or even holding no professional license of any kind to fund and run LLC bail operations in California, to be free from the penalties of existing law, and to simply restart any new bail LLC after the prior bail LLC falls from law violations.

It is my personal opinion that the current Bill, as is, forms an easily predictable legal quagmire forming a plethora of questions at law for attorneys and courts to work out and while those not holding a professional license but, arguably and predictably, collecting premium would never have to pay a summary judgment to any government entity because the LLC would simply liquidate to be followed by the next ‘incarnation’ by the same “subsidiary” employees in a perpetual cycle of collecting bail premium with no risk—in my personal opinion.

Furthermore, current law requires that “monetary payment” for exonerating a bond be paid by a “bondsman,” and summary judgment monies from a “bondsman” are to go to cities, counties and the district attorneys and county counsel offices may petition superior courts to be reimbursed pursuant to California Penal Code Sections 1306 (a) & (b); moreover, pursuant to California Penal §1308, while a court or magistrate may decline a bond from any person, corporation that has failed to pay a summary judgment, there is nothing in the Penal Code that forces a “subsidiary” to pay a summary judgment or bars a “subsidiary”from utilizing an auxiliary “LLC”that owns a corporation from picking up where the prior bad actor left off!

So, now the Penal Code will have to be altered to meet the predictably, logically conclusive, and obvious outcomes of allowing a “subsidiary” with no legal restrictions to transact bail under so many layers upon layers that “the object of bail” will be perverted; the rule of law regarding bail will become convoluted, and premiums can be collected with absolutely no contractual obligation from whomever is pulling the strings of the “LLC” that owns the corporation that can easily fold and pop up under a different name—just like the Senate Bill 1265 did as Assembly Bill 773!

Thank you for your time and patience and latitude,

Rex Venator

Bailspeak's Primary Instructor

“Excellent subject matter and great anecdotal flow. Great story telling which makes it easy to grasp subject matter. Vast wealth of knowledge. Made class fun.”

“Add more days! The information given was from someone with extensive expertise in the bail community.”

“Great class, great instructor. The break down of legal matters to layman terms.”

“Kept students involved.”

“The instructor’s lessons in order to make sense of subjects being taught. I am very pleased and confident in the material Rex taught the class. Very satisfied.”

“Rules and Regulations on becoming a Bounty Hunter.”

“Use personal knowledge with examples to supplement the text and statutes well. The professor, Rex’s knowledge and expertise in the area.”

“It almost felt like the teaching was one on one. I can’t think of anything I didn’t like. Thank you for putting this together.”

“Very illustrative. Makes it easy to understand. Good examples in all subjects.”

“Extremely informative. I signed up for the class to be a bounty hunter. I am now considering taking the bail exam.”

“I liked that we had many examples for every subject. The instructor is very informed and gives very knowledgeable information.”